Merchant fees have interest because they are a commercial transaction between a third party which the. Place of supply for renting of immovable property.

Hsn Sac Codes List Gst Rate Finder Hostbook Limited

You have to only type name or few words or products and our server will search details for you.

. Self-review for Eligibility of JSS JGI and SBRG. The above conditions are fulfilled. Pankaj Jakhar 47 Points Replied 02 September 2017.

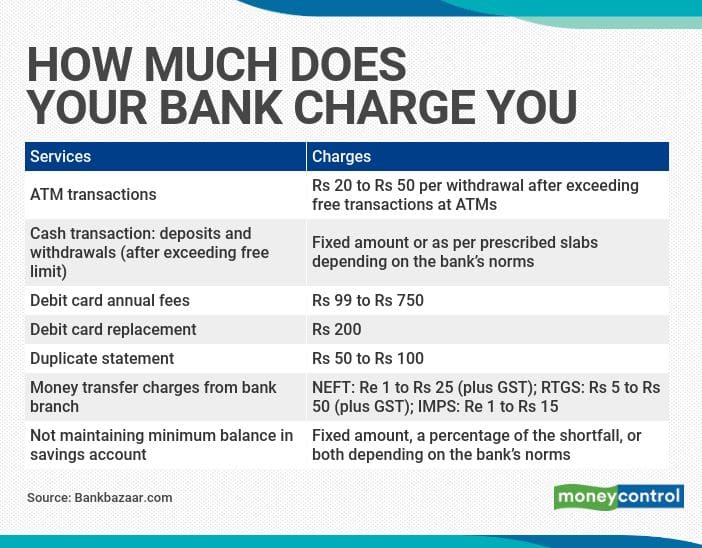

11 rows HS Code GoodsService discription SGST CGST IGST CESS Conditions. Charges by local Bank HDFC Bank This consists for remittance related service charges and conversion charges. Accordingly if you are a registered taxpayer regular under GST you can take ITC for GST levied on bank charges.

Interest charged on late payments. SAC Codes Description of Services Rates 99. Services rendered in relation to the construction of any type of commercial buildings such as parking garages malls marriage halls hotels exhibition halls office buildings service stations petrol pumps airports terminals both road and rail theatres and so on.

Government council rates and water supply charges are not subject to GST. Specific Industries in Tiers and SSIC Codes. Any expenses paid for business purpose and gst paid on then can claim gst credit.

Financial and related services. Refund of GST - services rendered. Cars for disabled persons.

Jobs Growth Incentive JGI. Please will you confIrm the actual tax codes for Bank charges Merchant fees Tx 0 Kudos ronatbas. Ultimate Partner Australia.

With respect to corresponding bank charges foreign bank charges first it is charged to HDFC Bank which ultimately recovered from the end customer. You are adviced to double check rates with GST rate book. 1B GST on purchases.

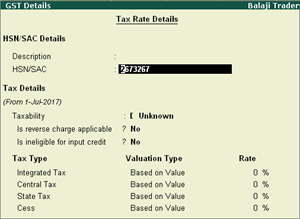

GST RATE ON SAC CODE - 997111 IS 18. The interest income received from the bank should be reported as your exempt supplies in Box 3 of the GST Return Total Value of Exempt Supplies. GST rates for all HS codes.

Yes for escrow and cc gst credit also available. Answer 1 of 5. 29 Common GST Mistakes.

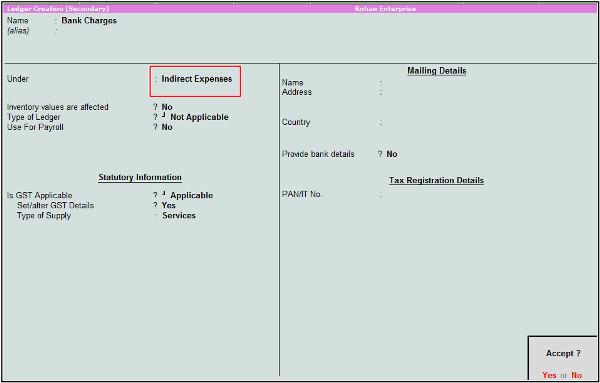

GST GST errors GST Mistakes. GST Credit GST Group Code and HSNSAC Code should not be blank on Bank Charge Code. According to clause c of sub-section 3 of section 31 of the CGST Act 2017 read with Rule 49 of the CGST Rules 2017 the banks are.

You can use the Out of Scope code for bank charges fees. Capital acquisition GST item. For GST to be charged on particular sale or serviceIt should fall under definition of Supply.

As banks are providing value-added services to. Specifies the lower limit of the bank. It is clear these services are liable to GST under forward charge by the local bank.

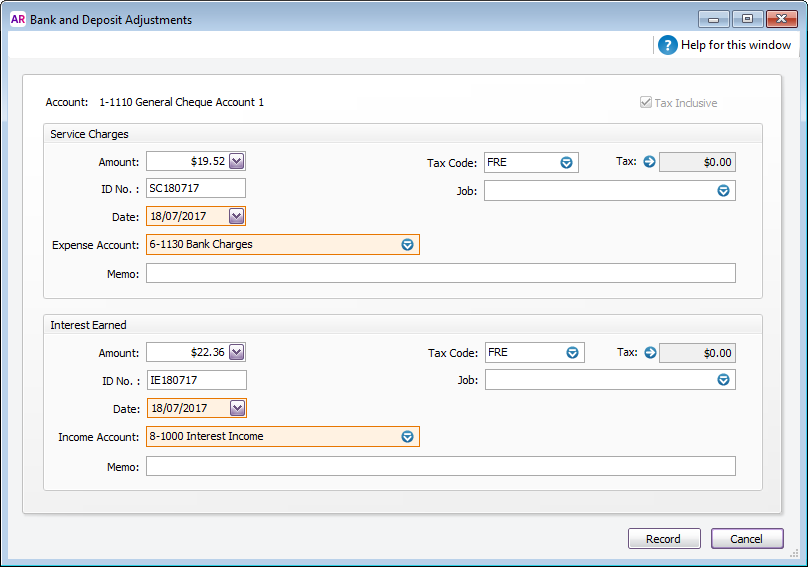

The correct code for bank charges is FRE. If you have a tax invoice for the merchant fees then yes it would be GST code with the GST portion as per the invoice. In relation to the BAS already lodged I would contact the accountant and ask for their advice in relation to what they would like done about that.

Dishonor of Cheque - insufficiency of funds - acquittal of the accused. Here is a list of GST codes and terms that comply with the Australian BAS. Have a great day.

Bank charges exclude gst ac dr. From my understanding I know that bank charge should be input tax then it should be NCI tax. Audit observation payment via DRC 03.

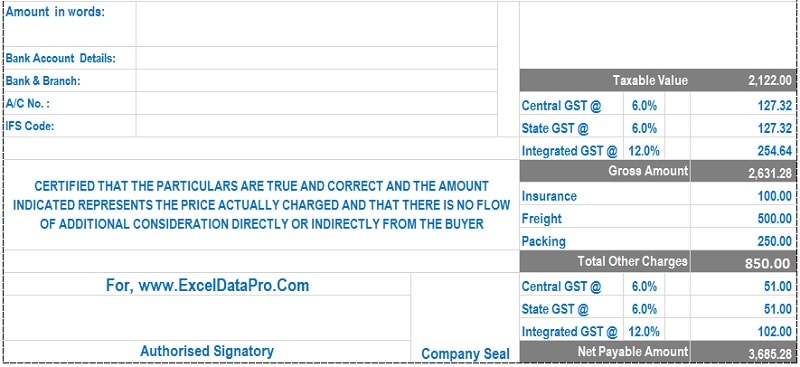

With the details of all the charges levied during such month and GST charged thereon. September 2015 edited July 2020. If you pay bank charges through current account the gst credit can claim.

Twelfth WTO Ministerial Conference all set to begin from 12th June 202. Specifies the code of Bank Charge from drop down list. As per Rule 542 of CGST Rules 2017 Banks shall issue a tax invoice or any other document in lieu of tax invoice.

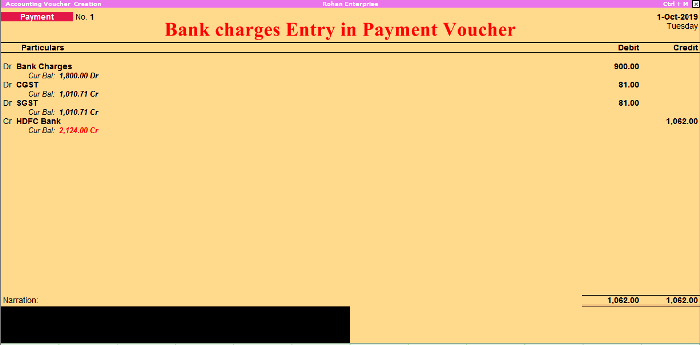

Intra-State Bank Payment with GST on Bank Charges where Input Tax Credit is available for example bank charge of INR 10000 to be paid to bank and GST 9 CGST and 9 SGST has to be calculated on bank charges amount. You will have to charge GST on 1500 which is the rental value of. Supply is defined under section 7 of CGST act.

ITC on Bank Charges can only be claimed by the taxpayer if he has furnished the return specified under Section 39. Tax code for bank charge. 30 rows Issuance of Bank Statement Charges.

I want to confirm the tax code for general monthly bank fee. In simple terms for anything to fall under supply it should comply these three- There should be Consideration It should be Tax. Fruit and vegetables and other foods.

March 12 2019 1246 PM. Even though the Goods and Services Tax GST has been in operation for more than 20 years despite its best efforts to educate the general public the Australian Taxation Office ATO is still receiving business activity statements BAS containing many. Is it blank like stamp duty and government rates and charges or is it NCI.

GST on bank charges. Guide For The Banking Industry 2 Fees charged for services provided as part of a main exempt supply. ITC for GST on bank charges is available in terms of CGST Act subject to fulfilment of conditions prescribed therein.

Ambulance levy some states and territories only. It is to be noted that ITC for GST on bank charges is not blocked by the provisions of section 175 of the CGST Act. Financial services except investment banking insurance services and pension services 997111.

GST entry of Bank Charges in Tally. Hence GST Credit can be claimed on bank charges. Fees charged for leveraging on the banks network 38 The banks may also provide services which enable other businesses to reach out to the banks customers.

Services by an entity registered under section 12AA of the Income-tax Act 1961 43 of 1961 by way of charitable activities. Bank fees have FRE from the time that the government ruled that finance expenses would not have GST. You can search GST tax rate for all products in this search box.

GST Code total amount of invoice as GST and manually override GST dollar amount to reflect GST shown on the invoice. Capital acquisition GST free item. Reckon Account Enterprise 2015.

GST credits cannot be claimed on. Tax rates are sourced from GST website and are updated from time to time. Bank Charges are a type of expense and GST levied on them will form part of the input.

As per GST Law GST is applicable on bank charges and ITC can be availed for specified services.

Gst Rates 2022 Complete List Of Goods And Service Tax Rate Slabs

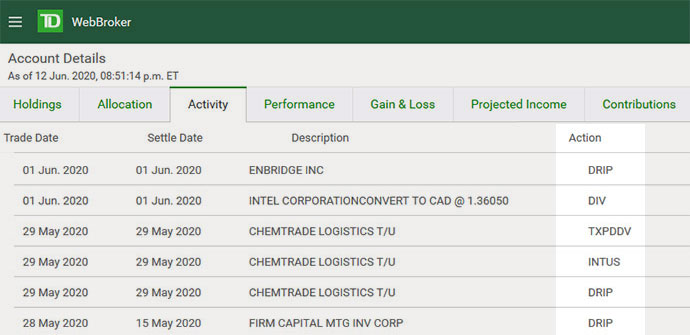

What Bank Transaction Codes Mean Your Account Activities Explained

Printing Hsn Sac In Your Invoice

Tally Bank Charge Entry क स कर Bank Charges Gst Entry Tally In Hindi

Tally Bank Charge Entry क स कर Bank Charges Gst Entry Tally In Hindi

Gst India Goods Service Tax In Sap Treasury Transaction Manager Configuration User Manual Sap Blogs

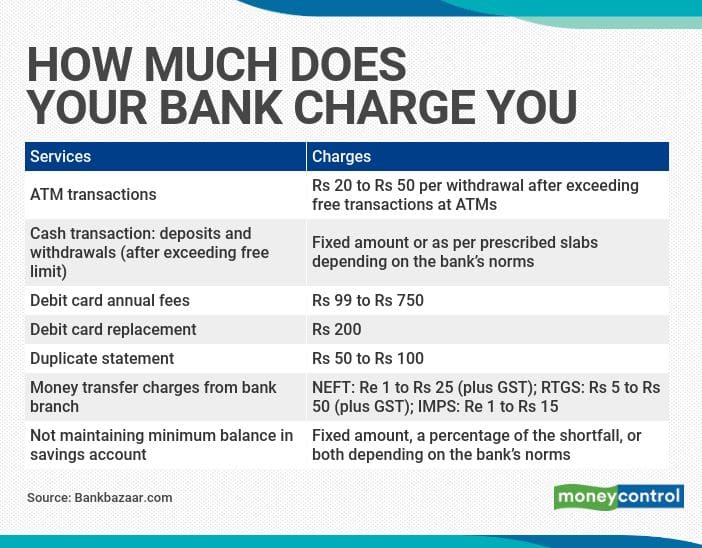

Do You Know How Much Your Bank Charges And Penalises You Read On

Gst India Goods Service Tax In Sap Treasury Transaction Manager Configuration User Manual Sap Blogs

Download 10 Gst Invoice Templates In Excel Exceldatapro

Bank Interest And Charges Myob Accountright Myob Help Centre

Printing Hsn Sac In Your Invoice

Printing Hsn Sac In Your Invoice

Examples Of Tax Explanation Code Accounting

Gst Charges For Cheque Bounce By Banks Inadequate Balance Non Financial Reasons

Tally Bank Charge Entry क स कर Bank Charges Gst Entry Tally In Hindi

Mandatory Hsn Sac Codes In Gst Invoices From 01 04 2021

Printing Hsn Sac In Your Invoice

Gst On Bank Charges Deducted On Inward Remittance Of Exports